However, this company isn’t a fantastic suit in the event you’re wanting to include anyone to the account, because Avant doesn’t allow co-signers or co-borrowers.

Own loans are usually unsecured loans in amounts from a couple of thousand to tens of Countless bucks that folks use for different needs.

Lake Michigan Credit history Union (LMCU) earns the nod for very best modest financial loan lender mainly because it offers individual loans as tiny as $250—the smallest within our databases with fair rates and terms.

And In the event the bank loan company restricts ways to make use of the money, take into account whether or not the bank loan however satisfies your requirements.

Before taking out a financial loan, be sure you Have a very system for the way you are going to utilize it and pay it off. Inquire by yourself simply how much you need, the amount of months you have to repay it easily And the way you propose to finances for the new regular monthly expense. (Find out more about what to take into consideration when having out a loan.)

Upstart considers factors like instruction, employment, credit history heritage and do the job expertise. If you'd like to learn your APR before you decide to implement, Upstart will execute a comfortable credit score Verify.

Our editors are dedicated to bringing you unbiased scores and information. Our editorial written content just isn't affected by advertisers.

Just about every lender advertises its respective payment restrictions and loan dimensions, and finishing a preapproval procedure can provide you with an concept of what your desire price and regular monthly payment could well be for this kind of an total.

As soon as you post your application, you might be accepted for a range of personal loan possibilities. Every may have a distinct period of time to pay for the loan again (your time period) and another curiosity charge.

Upstart does evaluation your credit profile when making a lending decision, but it takes advantage of Highly developed underwriting program to critique substitute information like education, get the job done knowledge and employment that can help Assess borrowers.

The speed there's a chance you're offered might be much better or worse than the average (with any luck , it's better), but finally that will count on the energy of the credit score profile.

And with LendingPoint, it may assist you qualify for a better interest rate. The company suggests it will eventually review your account after 6 months and should decreased your fee in case you’ve been generating on-time payments.

Lastly, a personal loan from an institution you have already got a romantic relationship with, like a bank or credit rating union you do have a checking or price savings account with, may perhaps supply a much more streamlined acceptance course of action.

The new particular mortgage click here will then lessen the common age within your credit score accounts, which often can also negatively influence your rating. But if you persistently make on-time payments on The brand new private mortgage plus your other obligations, your credit score can rebound after a while.

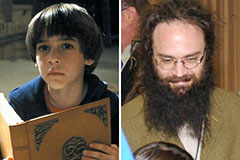

Jake Lloyd Then & Now!

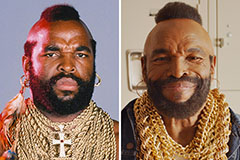

Jake Lloyd Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now!